Depending on the country where the shop is located and their tax system and regulations, it may happen that a shop needs a specific configuration for taxes.

GEM-CAR is a versatile tool able to adapt to many situations and configurations. If you have a special configuration, let us know so we can assist you!

GEM-CAR allows users to set up as many taxes as needed, cumulative or not, etc. All this is done via the ‘Tax Group Management’ window

| Example: (Y) = Subtotal products and services 150$ (A) = TAX 1 = 18% (B) = TAX2 = 5% |

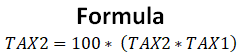

The tax configurations should be : TAX1= 18% TAX2 = 100 x (18% x 5%) = 0.9% Total = Y + A + B |

Click here to ask for a free demo

Click here to ask for a free demo