- Step 1 : Return the paid invoice amount to the customer's account (in AR)

- Step 2 : Return the cashed amount to the correct account (ex: Check, MasterCard, Check, ...)

- Step 3 : Payment collection (AR) with the necessary corrections.

THIS PROCEDURE WILL NOT AFFECT YOUR TECHNICIAN PERFORMANCE AND TAXES

Step 1 - Return the paid invoice to the customer's account

View your invoice to reverse and take note:

- the amount,

- payment method

- the date

- If necessary, the number of the invoice included in the payment

Once this information is in hand, follow the instructions below:

From the Point of Sale,

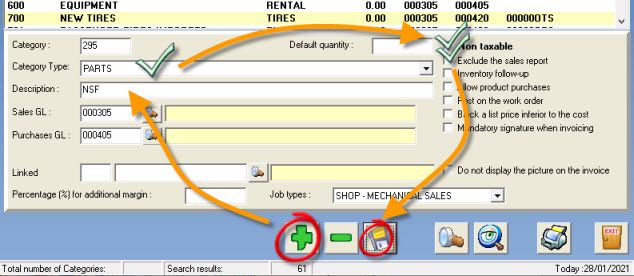

a) create the category

- Create a new part type category (ex: 295: 'NSF"),

- Configured as a PARTS TYPE

- Non-taxable,

- Exclude from sales report,

- Enter a description,

- Save,

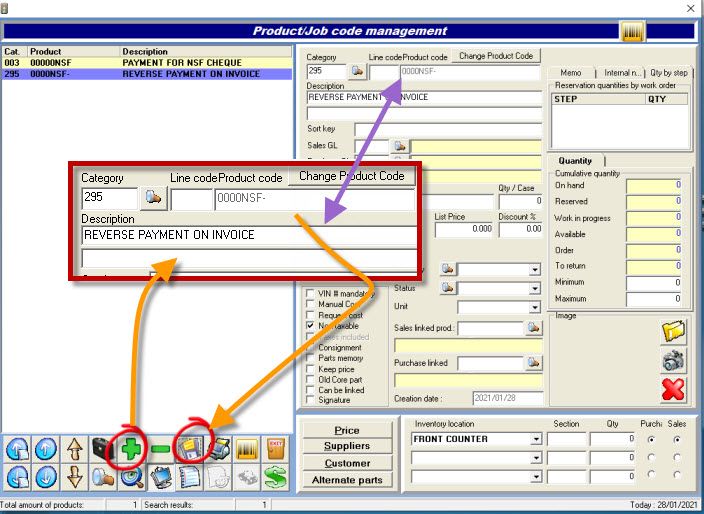

b) create the product:

- Open the inventory window (Spyglass in the line item from the grid in POS)

- Click the "+",

- Chose the category: 295,

- Enter a new code (ex: ADJUST ) and continue,

- Save.

C) Back in the POS,

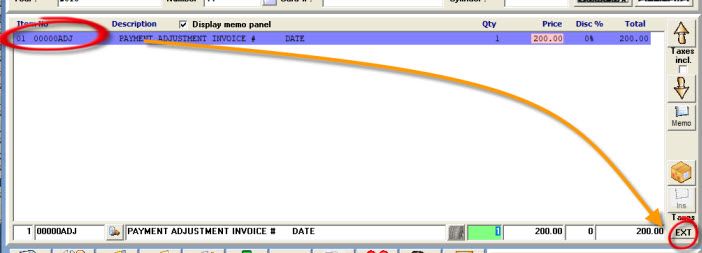

- Make a new estimate for this client,

- In the product line, enter a new code (ex: ADJUST ) and continue,

- Leave the default quantity ( 1 ),

- Enter the price that corresponds to the amount of the paid invoice,

- Save.

- You can verify the taxes by clicking on the product line you have just created and click on the small " EXT" button to the right of the line for adding a product,

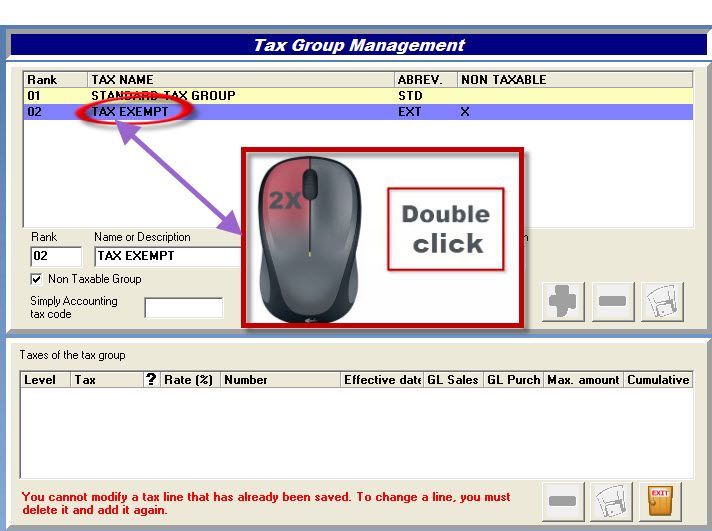

- Click twice on your " NON TAXABLE " tax group (ex: "TAX-EXEMPT"),

- Click "F4" to close the invoice,

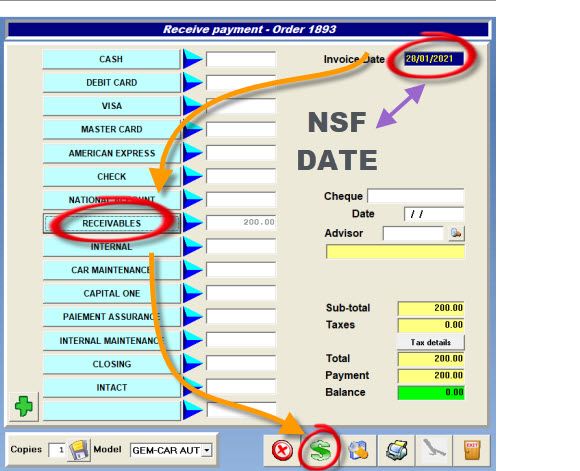

- Change the date to the NSF date,

- Select the payment "Receivable",

- Click on the $ icon,

- NOTE that the date of NSF transaction is normally 5-7 days from the original transaction

Step 2 - Remove the payment received of the payment on record (Check, MasterCard)

- Repeat exactly the same procedure from the previous step, changing only:

- The description of the product (ex: RETURN TRANSACTION: CHECK invoice # 50020 ),

- The quantity of the product at -1,

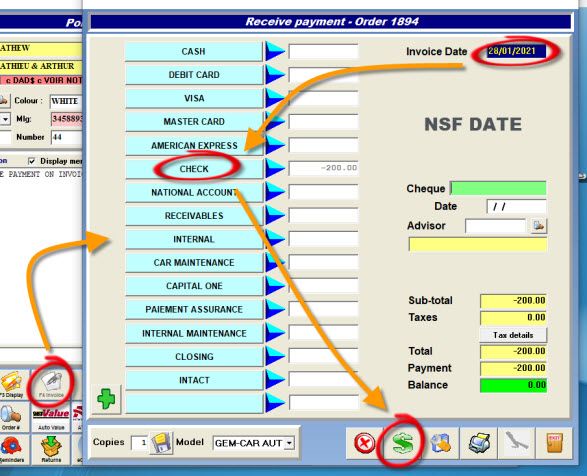

- Click on F4 to close the invoice,

- Change the date to the NSF date,

- Select the payment Ex: "Check",

- Click on the $ icon,

- When invoicing, enter the correct transaction date of the NSF, the same method of payment as the payment received from the customer (ex: CHECK ),

- Click on the dollar sign "$" to close the invoice without printing or click on the printer to print.

Step 3 - Apply for the payment on the account after the collected NSF is eventually received

- Create a new estimate in the name of the same client,

- Click on the green dollar sign "$" or enter your "Account Receivable" product code (ex: AR),

- Select the invoice to pay,

- Close the invoice as usual, with a memo "NSF invoice for audit trail" the current date and method of payment.

- For more detail, visit the FAQ : How to register a payment on an account receivable customer?

Click here to ask for a free demo

Click here to ask for a free demo